When Thomas J. Harper, president of the West Town State Bank, opened for business on the morning of May 24th, 1930, he could not have known it would be the last such opening for some time. That day, after spending seventeen years in a two story building on West Madison Street (fig. 1), the company re-opened in a new nine story “office bank” across Western Avenue (fig. 2). The new building was last of its kind in a number of ways, marking the end of an era of Classical decadence in local bank architecture.

Like many other building projects completed early in 1930, the West Town building was planned, financed, and begun before the 1929 stock market crash. The effects of the crash were not felt by most banking institutions until 1931. For example, after opening the new building in May 1930, West Town State Bank failed little over a year later in June 1931. The Great Depression did not create an absolute cessation in all new construction, however, no new outlying bank buildings were built in Chicago until around 1945.

Left: Illinois Historic Preservation Agency. Right: Jensen & Halstead.

Designed by Mundie & Jensen, West Town was the last tall outlying bank built within city limits until Heritage-Pullman in 1974 (fig. 3). Interestingly, Mundie & Jensen was the successor firm of William Le Baron Jenney, the architect of the Home Insurance Building, arguably the first skyscraper, as well as the Horticulture Building at the World’s Columbian Exposition.

The Modern Classical style used in the bank’s design was an intermediate compromise between Classical Revival and Modernism, and was employed frequently in the 1930s and 1940s by conservative institutions. Even though many Modern Classical banks were built throughout the country during the 1930s, West Town was the last bank built in Chicago with any resemblance of Classicism. By the time new bank buildings were being constructed in the mid-1940s, a clean stylistic break had been made (fig. 4).

Chicago Tribune Chicago Tribune

Fig. 3, Heritage-Pullman Bank, 111th Street & I-94, 1974.

|

Although less than seventy remain today, there were 337 banks operating outside of Chicago’s Loop by 1929. Each differed, if slightly, in design and layout. The two primary reasons for this heterogeneous abundance are restrictive state laws forbidding branch banking and the explosive real estate boom that occurred between the 1893 World’s Columbian Exposition and the 1933 Century of Progress Exposition. In short, each bank company was legally obligated to have only one location while demand for banking facilities across the metropolitan region was concurrently high.

Banks in the central business district, especially clearinghouse banks, were (and continue to be) crucial to the solvency of outlying banks. These institutions provide commercial loans and set interest rates among other functions, but until relatively recently, most did not provide retail banking services to the general public. From an architectural standpoint, downtown banks are generally indistinguishable from other skyscrapers. Most now have banking floors at ground level, but these buildings are comprised largely of offices and can be better understood within the narrative of skyscraper development.

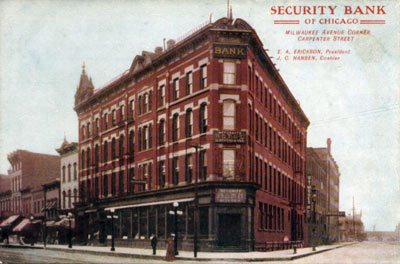

Similarly to the way contemporary retail branch banks are sited, many unit banks of the 18th and 19th century began as small operations in rented storefronts (fig. 5). Once a bank reached a new level of prosperity, outgrew its modest environs, or both, the company would buy a plot of land, often in the vicinity of the rented location, and erect a purpose-built bank (fig. 6). Because banks were restricted to a single location, the purpose-built bank would house that bank’s offices in addition to the banking floor. We are intentionally glossing over banks occupying retail space, or even modifying the exterior of a retail storefront. As with skyscraper banks, storefront banks warrant a separate discussion.

Illinois Historic Preservation Agency Illinois Historic Preservation Agency

Fig. 4, Central National Bank, 728 W. Roosevelt, Graham, Anderson, Probst & White, 1947.

|

There are three general types of purpose-built outlying banks; office banks, corner banks, and mid-block banks. Office banks are the tallest and most expensive. At thirteen stories, Sheridan Trust & Savings in Uptown is the tallest outlying bank erected in the 1920s (fig. 7). It is the quintessential office bank in which the bank company uses the ground level as a banking floor and is headquartered in some of the office space while renting the remainder of offices to other businesses. Effectively junior skyscrapers, they range from four to thirteen stories in height and were only built in areas with a demand for office space.1

Office banks functioned as both headquarters for the bank and as a real estate investment. Often, these buildings were erected by large national banks as they were not even permitted to own real estate other than their own building.2 This was a somewhat risky endeavor. If space could not be rented, the bank could have taken a huge loss and even risked folding, although no major office banks folded directly as a result of such speculation.

Owing to prominence and visibility, corner lots are more desirable and expensive than mid-block lots and the design of corner banks tends to reflect this, especially if the bank is on two major streets. There are facades on two of the four sides of corner banks, whereas mid-block banks only have one facade(fig. 8). Mid-block banks tend to be smaller, less expensive, and less ornamented than their more prominently sited counterparts(fig. 9).

Chicago History In Postcards

The Gold Standard Act of 1900 allowed a bank to open with a minimum of $25,000, significantly less capital than previously allowed. Following the panic of 1907 that wiped out numerous outlying banks, there was a proliferation of private concerns operating without a state or national charter. In the words of banking historian F. Cyril James, these “had spawned like mushrooms.”3 Private banking was prohibited in Illinois in 1923, requiring new operations to acquire a national or state charter.4

Chicago’s outlying banks are relatively diverse in appearance. Although a given architect such as Karl Vitzthum may have designed similar buildings, there are no two banks that are exactly the same. There is also a wide gamut in terms of the cost of this panoply of banking architecture. The reason for this stems from laws in effect at the time restricting branch banking. Chicago’s outlying banks are unit banks, each an independently chartered organization as opposed to satellites of a large central bank. Thus, a given building reflects the prosperity and aspirations of a smaller (local) population segment more closely than do branch banks.

Fig. 7, Sheridan Trust & Savings Bank #2, Marshall & Fox, 1133 W. Lawrence, 1924, four-story addition, 1928.

|

Although the First National Bank of the United States established branches as early as 1800 in large east coast cities, branch banking dropped out of fashion all over the country following the passage of the National Banking Act of 1863. The act did not expressly state that nationally chartered banks could establish branches, and The Comptroller of the Currency’s office interpreted this omission as a prohibition. This was the catalyst leading to the early demise of the practice, resulting in a national banking system comprised primarily of unit banks. Additionally, many states, Illinois included, had in place laws restricting branching for state chartered banks.5

Branching restrictions were formalized as a states rights issue with the McFadden Act, passed by Congress in 1927. The act permitted national banks to operate within the framework of state branching laws, allowing them to branch in states that did not forbid the practice. For example, Michigan allowed it, and Detroit is replete with outlying branch banks as opposed to Chicago’s outlying unit banks. This only applied to intrastate branching however, nationally chartered banks could not engage in interstate branching. Thus, a nationally chartered bank in Michigan could not build a branch in Illinois. The restriction was fully repealed in 1994 with the passage of the Riegle–Neal Act, which allows states to opt in to interstate branching. After a series of branching deregulations beginning in 1967, Illinois fully permitted interstate branching in 1997.6

The World’s Columbian Exposition in Chicago was financed just prior to the panic of 1893. The panic forced many New York banks to close due to an erosion of depositor confidence leading to widespread bank runs. Two large national banks in Chicago also failed. The concurrence of bank failures in the two largest American cities at the same time as the Columbian Exposition doubtlessly had an effect on bankers looking to restore public confidence in the banking system. Chicago thus became the locus of conservative American architectural fashion as the Classical Revival style was popularized at the Columbian Exposition by prominent 1890s architectural firms McKim, Mead & White and Daniel Burnham & Co.7 Architects working in this style did not faithfully echo ancient canonical forms, as was done with the 1820s Greek Revival, instead fashioning an eclectic mish-mosh of elements from Ancient Greece, Imperial Rome, and Renaissance Italy.8

There was explosive growth in the financial sector and the building trades in the years following the 1893 Columbian Exposition. The forty year period between the 1893 and the 1933 Century of Progress Exposition saw the greatest building boom in the history of the City of Chicago. Outlying banks both facilitated this boom and benefited from it. In 1899, there were only seventeen state chartered outlying banks in the city. This number grew to forty-six by 1908, and to sixty-nine by 1913. During that time, many different types of buildings were constructed in the Classical Revival style, including train stations, government buildings and movie palaces. Perhaps the style was most suited to, and found its greatest expression in banking architecture.

Ryerson-Burnham Libraries, SAIC Ryerson-Burnham Libraries, SAIC

Fig. 10, Illinois Trust and Savings Bank, Quincy & LaSalle, Daniel Burnham & Company, 1896, demolished.

|

The vocabulary of Classical Revival architecture appeals to a deeply embedded cultural understanding of permanence and offers a compelling signification of lofty ideas such as stability, security, and strength. The style remained in vogue until it was first supplanted by Art Deco, then Modern Classicism, and finally Modernism as advertised at the Century of Progress Exposition. Even though the Classical Revival style has been out of fashion for over seventy years, four columns and a pediment still signifies “bank.”

Considered the first great example, Stanford White’s Bowery Savings Bank in New York City, designed in 1892 and finished in 1894, ushered in the era of Classical Revival banks.9 In the years immediately following the Columbian Exposition, Classical Revival banks were also built in Chicago. The Illinois Trust and Savings Bank, designed by Burnham & Co. in 1896, was an early example of a corner bank in this style (fig. 11). Stanford White is responsible for another early influential New York bank, the Knickerbocker Trust Company, built in 1902, which had a strong influence on the design of numerous banks around the country (fig. 12).10 These three early Classical Revival banks comprise a template that would be repeated in smaller banks in Chicago and across the United States.

It would take another decade for the style to infiltrate the Chicago’s outlying areas. Until they were prosperous enough banks occupied ground floor retail rental space. These banks eventually prospered through increased financial activity in newly developing neighborhoods and suburbs, a symbiotic relationship that grew out of a real estate boom. More and more outlying banks opened in response to increasing demand for local banking institutions as outlying areas gained in population.

Banks provided financing for construction projects and then facilitated the sale of properties by lending to the purchaser.11 This depended in turn on a growing middle class population migrating outward from the city center and inward from rural hinterlands. By 1929, there was a plethora of outlying banks operating in Chicago and its hinterlands. The imposing Classical Revival bank located on a major intersection of an outlying area became symbolic of the literal and figurative arrival of an entire community.

City University of New York Fig. 11, Knickerbocker Trust Company, 5th Avenue & 34th Street, New York City, Stanford White, 1902, altered.

|

When the boom began to slow down, collapsing suddenly in 1929, the outlying banks struggled for survival. Between October 1929 and July 1931, an astounding forty-five mergers took place. Of the 337 outlying banks that were operational before the stock market crash, only 197 survived through June 1931. As for the 318 banks organized within Chicago between 1921 and 1935, 263 were out of business by 1938 either through failure or consolidation. A positive result of this widespread failure was that the surviving banks were financially solid.12

The Great Depression marked the end of popularity for the Classical Revival style. In the 1930s and 1940s, modernization became the primary concern for bank companies and quasi-public institutions generally. Just as the 1893 panic influenced architectural trends, so did the Great Depression. The staid, imposing banking architecture of the first half of the 20th century gave way to a luminescent, transparent, customer-service oriented design program. Most interestingly, with the passage of the Riegle-Neal Act in 1994, the rented retail siting of branch banks representing giant conglomerates such as Chase and Bank of America have brought banks back down to the storefront, full circle.

Nonetheless, early outlying banks remain in nearly every neighborhood, never identical but instantly recognizable. Clad in motifs borrowed from Ancient Greece, Imperial Rome, and Renaissance Italy, these buildings forcefully communicate their purpose. They are banks, and even if they have been re-purposed as restaurants, churches, or offices, they are still first and foremost, banks.

We have identified a mere 64 purpose-built outlying banks erected between 1893 and 1933, although we are likely missing a few. Clearly, a staggering number of these buildings have been demolished in the past 80 years. There are different reasons for this, the most obvious being that many banks fold through consolidation and the purchasing company sells off extraneous property in order to liquidate assets. In some cases an older bank building would be demolished to make room for a new bank building at the same location. Even though a bank is still located on a parcel of property, it does not show up in our survey because it is outside of the date range.

Banks occupied valuable real estate – in some cases a bank would be demolished and a different type of land use would follow. In many instances, the earliest prosperous outlying areas, especially Washington and Warren Boulevards to the west, and King Drive and Cottage Grove to the south, have been subjected either to urban renewal or disenfranchisement and decay. For example there are no pre-1933 bank buildings in the area bounded by the Chicago River, Monroe Street, 21st Place, and city limits near Kostner. Although the majority of outlying banks built between 1893 and 1933 have been demolished, a good cross-section remains, fifteen of which are protected as Chicago landmarks.

Click here to download a PDF list of extant banks.

1. Charles Belfoure, Monuments to Money: The Architecture of American Banks (Jefferson, NC: McFarland & Co., 2005), p. 165.

2. Belfoure, p. 117.

3. F. Cyril James, The Growth of Chicago Banks Volume II: The Modern Age 1897-1938 (New York: Harper, 1938), p. 828.

4. James, p. 953.

5. Daniel C. Giedeman, “Branch Banking Restrictions and Finance Constraints in Early-Twentieth-Century America,” The Journal of Economic History (2005), 65:1: xxx.

6. Tara Rice and Erin Davis, “The branch banking boom in Illinois: a byproduct of restrictive branching laws,” Chicago Fed Letter (2007), Federal Reserve Bank of Chicago, No. 238

7. Belfoure, p. 127.

8. Belfoure, p. 125.

9. Belfoure, p. 148.

10. Belfoure, p. 150.

11. James, p. 953.

12. James, p. 1096.

- Rogers Park National Bank

- East Side Trust & Savings Bank

- Pony Express

- Disused Fire Stations Part 1 – 19th Century

- Bygone Breweries